This website uses cookies for a better browsing experience.

If you agree to the use of cookies, please click the "Agree" button.

Please refer to the Privacy Policy regarding the use of cookies on this site.

Regarding Corporate Governance

Basic Policy

The Oiles Group positions corporate governance as a top priority and strives to continually strengthen the rationale, soundness, and transparency of its governance system and organization through flexible decision-making and delegation of authority in response to changes in the market and taking the necessary actions to develop our corporate Group and enhance its corporate value.

We also recognize the importance of actively disclosing appropriate information to investors in a timely manner to ensure transparency.

Corporate Governance Report

"Corporate Governance Report" submitted to the stock exchange where the company is listed.Corporate Governance System

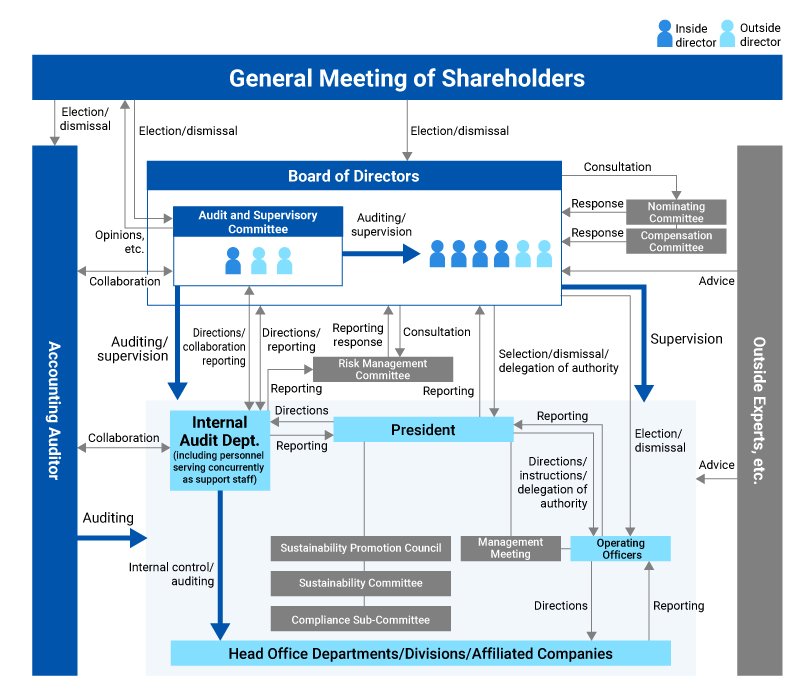

The company uses an audit system, under the company with auditors system, consisting of six directors, including two independent outside directors, and four auditors, including two independent outside auditors, as of the end of June 2023. The Board of Directors makes decisions on key management matters and oversees the management of directors’ execution of business. The Board of Directors is composed of five men and one woman. The Audit & Supervisory Board supervises the Board of Directors and execution functions, and auditors have developed a collaborative system with accounting auditors and the Internal Audit Office, including internal control.

We employ an operating officer system with the intent to clarify the separation of business execution functions and supervisory/oversight functions, as well as to bolster the functions of the Board of Directors through speedier, more efficient decision-making on management strategies. The current team is comprised of eight operating officers in total, including those who serve concurrently as directors (two officers). From April 2023, we have separated the Bearing Division into the General Plain Bearing Division and Automotive Bearing Division, in order to promote swift decision-making and clarify business responsibilities, and established a new Production Division to strengthen our production system. We will also clarify the roles and responsibilities of the directors and executive department by appointing operating officers responsible for each division, and shift toward flexible management by strengthening the management supervisory function while delegating executive power to operating officers.

Directors’ Skill Matrix

The table below indicates the areas of expertise and experience required for the Board of Directors to consider the management policies and strategies of the Oiles Group to contribute to continuous growth and improve medium- to long-term corporate value.

| Name | Current Position and Responsibilities at the Company | Areas of Expertise and Experience (Top Four*) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Finance, Accounting | Legal, Risk, Compliance | Technology, R&D, Production | Sales, Marketing | Internationality | IT Digital | Society, Environment (incl. ESG) | ||

| Masami Iida | Chairman, Head of Board of Directors | ● | ● | ● | ● | ||||

| Yoshikazu Sakairi | President, Chief Operating Officer, Nominating Committee Member, Compensation Committee Member | ● | ● | ● | ● | ||||

| Kazuharu Tanabe | Director | ● | ● | ● | ● | ||||

| Satoshi Miyazaki | Director | ● | ● | ● | ● | ||||

| Yasuji Omura | Independent Outside Director, Head of Nominating Committee Member, Head of Compensation Committee, Special Committee Member | ● | ● | ● | ● | ||||

| Rika Miyagawa | Independent Outside Director, Nominating Committee Member, Compensation Committee Member | ● | ● | ● | ● | ||||

Board of Directors

The Board of Directors consists of six directors (with all auditors, including independent outside auditors, present) and, in principle, meets every month. The board makes decisions on management policies, important management matters, cases stipulated by applicable laws and regulations, and the Articles of Incorporation, and supervises the execution of business. Outside directors are appointed to provide advice on management policies and important matters based on their considerable experience.

Audit & Supervisory Board

The Audit & Supervisory Board consists of four auditors, including two independent outside auditors, and in principle, meets once a month. The board determines the audit policy, the division of responsibilities among auditors, and other matters, and it receives reports from each auditor on the status and results of audits, thereby fulfilling the audit function for management. Also, the board appoints outside auditors so that it may draw from their abundant experience outside the company and strengthen the objectivity and independence of its auditing function.

Management Meeting

The Management Meeting is held in principle every month to discuss important matters related to the execution of business, with directors and executive officers in attendance. All auditors, including outside directors and outside auditors, also attend the meeting.

Nominating Committee and Compensation Committee

In October 2018, the company adopted a voluntary Nominating Committee and Compensation Committee system.

We established a voluntary Nominating Committee with a majority of independent outside directors to ensure the independence, objectivity, and transparency of nomination procedures of directors and operating officers. The Board of Directors determines directors and operating officers after undergoing a consultation and reporting process with the Nominating Committee (candidates for directors are submitted in proposals at general meetings of shareholders).

In addition, to ensure the effectiveness of the compensation system for directors and operating officers, a voluntary Compensation Committee is being established, with a majority of independent outside directors. As a result, the composition of compensation, policies, etc., are determined by the Board of Directors after consulting and reporting to the Compensation Committee. In fiscal 2022, the Nominating Committee met twice, and the Compensation Committee met four times. They are operating as intended.

- Nominating Committee

Chairperson: Yasuji Omura (independent outside director)

Members: Yoshikazu Sakairi(President), Rika Miyagawa (independent outside director) - Compensation Committee

Chairperson: Yasuji Omura (independent outside director)

Members: Yoshikazu Sakairi (President), Rika Miyagawa (independent outside director)

Sustainability Promotion Meeting

This body discusses important CSR (ESG) issues such as environmental measures, and is chaired by the president and attended by all directors and auditors. The meeting is held in principle twice a year (first and second half).

Concept of Compensation for Directors

Our compensation for directors is decided based on the following policy.

Compensation for Directors and Auditors

- The reason that the Board of Directors deemed that this policy was followed in the individual director compensation for the current fiscal year and the method for deciding the policy for determining individual director compensation.

In the Board of Directors meeting on February 25, 2021, we passed a resolution regarding the policy on deciding Individual Compensation for Directors. The Board of Directors has confirmed that the individual director compensation for the current fiscal year and the method for deciding that compensation align with the policy decided by the Board of Directors and respect the report by the Compensation Committee, and therefore, are deemed to follow the corresponding policies.

- Overview of Policies

a) Basic policy

We have adopted a compensation system linked with shareholder profit to ensure that director compensation functions properly as an incentive for continuously improving corporate value. Our basic policy stipulates that individual director compensation is decided within the range approved at the General Meeting of Shareholders and is at a fair level appropriate for the positions and duties of each director. In specific terms, executive director compensation consists of fixed compensation, performance-based compensation (bonuses), and performance-based stock compensation, and outside directors with supervisory functions are paid only fixed compensation and performance-based compensation (bonuses) in light of their duties.b) Policy for deciding fixed individual compensation

Fixed director compensation is paid on the same day as employee salary as monthly compensation from the first to the last day of each month, according to director regulations, and based on a comprehensive consideration of factors including individual ability, will, and involvement in achieving plans, achievements, contribution to business performance, and future positions to take on.c) Policy for deciding performance-based compensation, non-monetary compensation, and the method for calculating sums or figures

Profit attributable to owners of parent is adopted as the key indicator to reflect the performance of each consolidated accounting period in the performance-based compensation for directors, and bonuses reflecting duties and performance are paid within one week of the day the General Meeting of Shareholders concludes.

Non-monetary compensation is granted to directors (excluding outside directors, including operating officers) separately from fixed compensation and bonuses via a Board Benefit Trust (BBT) that aims to increase motivation to contribute to improving medium- to long-term performance and increasing corporate value, with the consolidated operating profit defined in the Medium-Term Management Plan adopted as the indicator to ensure that it contributes to improving medium- to long-term business performance. Stock compensation is decided by assigning points to recipients considering of factors such as recipient positions and indicator achievements in each fiscal year, based on officer payment regulations. In principle, directors receive company shares and other compensation when they resign.

* The Board Benefit Trust (BBT) system was adopted based on a resolution made at the 67th Ordinary General Meeting of Shareholders held on June 28, 2018.d) Policy for deciding the ratio of fixed individual compensation, performance-based compensation, and non-monetary compensation to individual director compensation

The Compensation Committee considers the compensation ratio for executive directors based on a benchmark of other companies of a similar size in related industries, with higher positions giving more weight to performance-based compensation. The Board of Directors respects the report by the Compensation Committee and decides upon the individual director compensation ratio within the range indicated in that report.

The standard compensation ratio is usually

65:25:10 (fixed compensation to performance-based compensation (bonuses) to non-monetary compensation (Board Benefit Trust)).e) Items for deciding individual director compensation

Individual director compensation is based on a Board of Directors resolution upon consultation by the Compensation Committee, which consists of a majority of independent outside directors. The Compensation Committee decides on fixed compensation for each director and allocates bonuses based on the performance of the business each director is in charge of. The Board of Directors makes a final decision based on the report's content by the Compensation Committee. For performance-based stock compensation, individual shares are assigned based on officer stock payment regulations.